The assessed value of properties in B.C. has stabilized on average, with some outliers such as Lytton, Haida Gwaii and Tumbler Ridge recording big jumps in worth.

According to statements released Tuesday by the B.C. Assessment Authority, property values as of July 1, 2023, changed on average between minus 10 per cent and plus five per cent.

In the Lower Mainland, the range was between minus five per cent and plus five per cent.

“Across the Lower Mainland and throughout B.C., the overall housing market has generally stabilized in value,” said B.C. Assessment’s lead assessor, Bryan Murao.

“Most homeowners can expect only modest changes in the range of minus five per cent to plus five per cent. These assessment changes are notably less than previous years.”

For example, the average detached home in Vancouver rose in value nine per cent in 2022 and 16 per cent in 2023.

“Commercial and industrial properties are generally increasing in value at a higher rate than residential, especially in areas such as the Fraser Valley where properties are up in value as a result of limited industrial land,” Murao said.

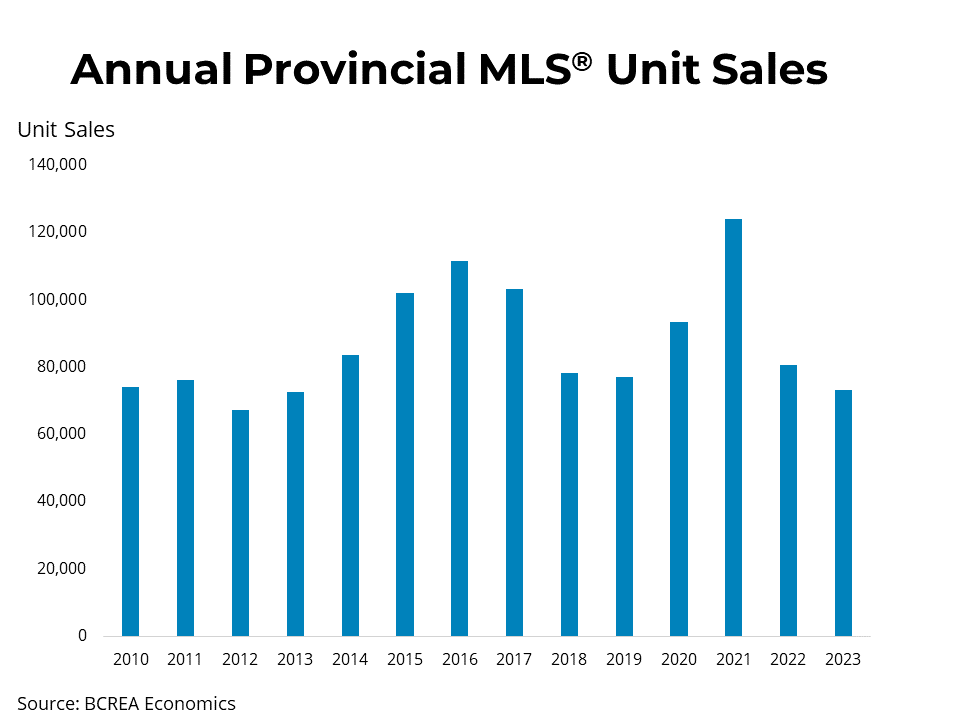

Andy Yan, the director of Simon Fraser University’s City Program, said the flattening of prices was due primarily to the Bank of Canada’s policy over the past two years of raising interest rates as a way to cool inflation.

Yan also noted that the recent assessments were made on July 1, 2023, before the provincial government introduced legislation forcing municipalities to allow densification, a move that will likely impact prices moving forward.

“The new legislation may not necessarily immediately lead to increased values, but set a floor of pricing expectations that current owners are reluctant to leave,” he said, noting 41 per cent of home owners in Metro Vancouver do not have a mortgage.

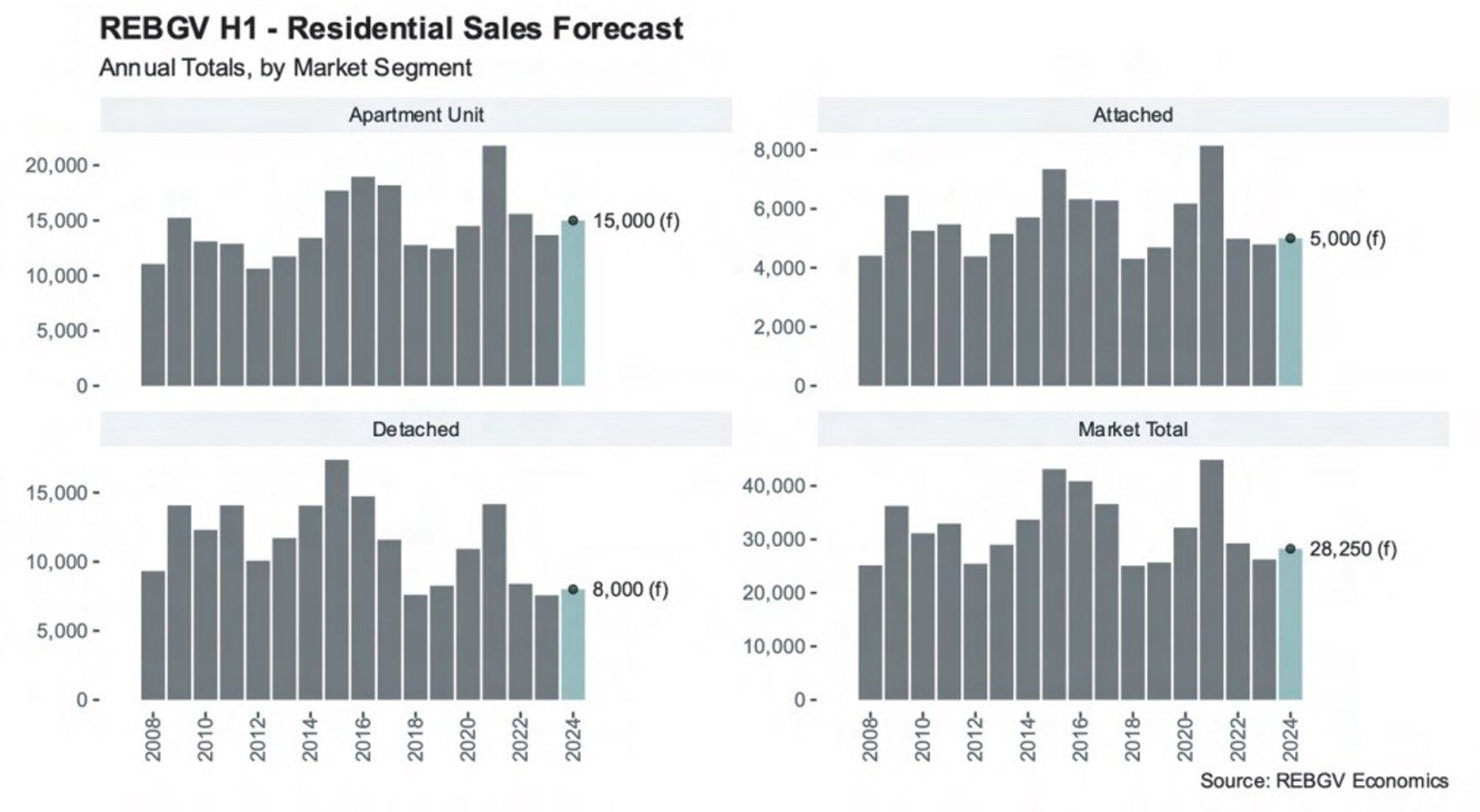

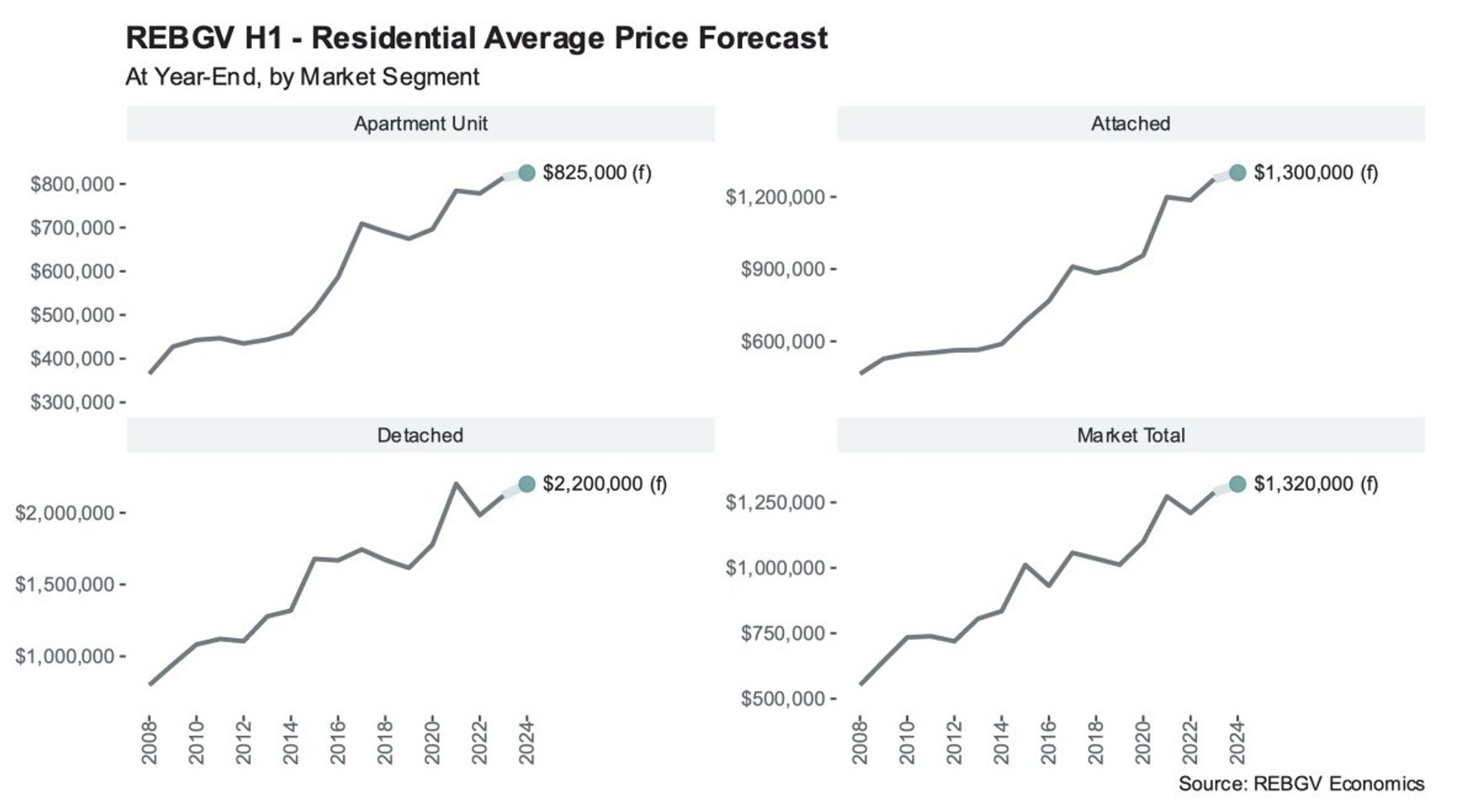

Realtor Steve Saretsky agreed that the jump in interest rates had led to stalled property values. He said that since July 1, 2023, the housing market had further softened but could pick up this spring if the Bank of Canada brings its benchmark interest rate down.

For the Lower Mainland region, the overall total assessments values increased from about $1.94 trillion to nearly $2 trillion.

Almost $27.2 billion of the region’s increased assessments is from new construction, subdivisions and the rezoning of properties. B.C. Assessment’s Lower Mainland region includes all of Greater Vancouver and the Fraser Valley, as well as the Sea to Sky area and the Sunshine Coast.

At the top end, for a single-detached home, assessed values went up four per cent in Vancouver, Burnaby and Coquitlam. The average detached home’s value in Vancouver is now $2,209,000.

The average assessed value of a detached home in Surrey didn’t budge, sitting at $1,609,000. The worst performer in the region was the District of Hope, which had a 13 per cent decline in assessed value with an average detached home now worth $611,000.

The value of a detached home in Hope rose 14 per cent last year, and 45 per cent the year before during the COVID-19 real estate boom when buyers were seeking properties outside the city.

In a big change over last year, the average assessed value of a detached home in Whistler went down two per cent and is now $2,842,000. Last year a detached Whistler home rose in value 11 per cent, and 29 per cent the year before.

When it comes to the strata property class (condos and townhouses), the best performer in the Lower Mainland was Richmond, where the average condo went up in value four per cent to $779,000.

Vancouver Island had the same range of movement in assessed value as the Lower Mainland — between minus five and plus five per cent.

However, this was skewed by a very strong performance in the north of the island that outweighed an overall decline in value across Greater Victoria and the Central Island.

Figures shows a drop in value in all Greater Victoria’s 14 assessment regions, with detached homes in Colwood and Esquimalt falling three per cent.

In the Central Island, on average a detached home in Lake Cowichan fell nine per cent, while the drop was four per cent in Ladysmith.

In the North Island, a detached home in Port Alice rose 34 per cent, Port McNeill 15 per cent, Alert Bay 20 per cent and Tahsis 10 per cent.

Vancouver Island deputy assessor Matthew Butterfield said the large increase in values in smaller North Island communities was due to strong demand and lack of supply.

Southern Interior deputy assessor Boris Warkentin said that his region had value changes somewhere between minus 10 per cent and plus five per cent. Kelowna, Penticton, Summerland, Princeton and Salmon Arm all had a drop in the assessed value of a detached home, while those values rose in Armstrong, Vernon and Coldstream.

Warkentin said the value of properties in the fire-ravaged community of Lytton rose 26 per cent due to increased market activity.

Northern B.C. had a similar rate of change as the Southern Interior, with the exception of Haida Gwaii (increase 22 per cent) and Tumbler Ridge (increase 19 per cent).