The fundamental factors of Metro Vancouver's real estate market — population growth and household formation — remain strong, and 2024 is "poised to be a growth year for the residential market," according to a forecast published by the Real Estate Board of Greater Vancouver (REBGV) last week.

Entering the new year, inflation is no longer an immediate threat like it was entering 2023, when there were concerns about a recession. Inflation is declining slowly, but declining nonetheless, and REBGV notes that bond and derivative markets are also now pricing in over 1.00% of anticipated interest rate cuts from the Bank of Canada, with much of those cuts expected in the first half of the year.

"These factors have the spring and summer markets coiled and ready for a strong first half to the year," says the REBGV.

REBGV is expecting a 0.50% decrease in the Bank of Canada policy rate, at a minimum, and is thus projecting an increase in sales activity.

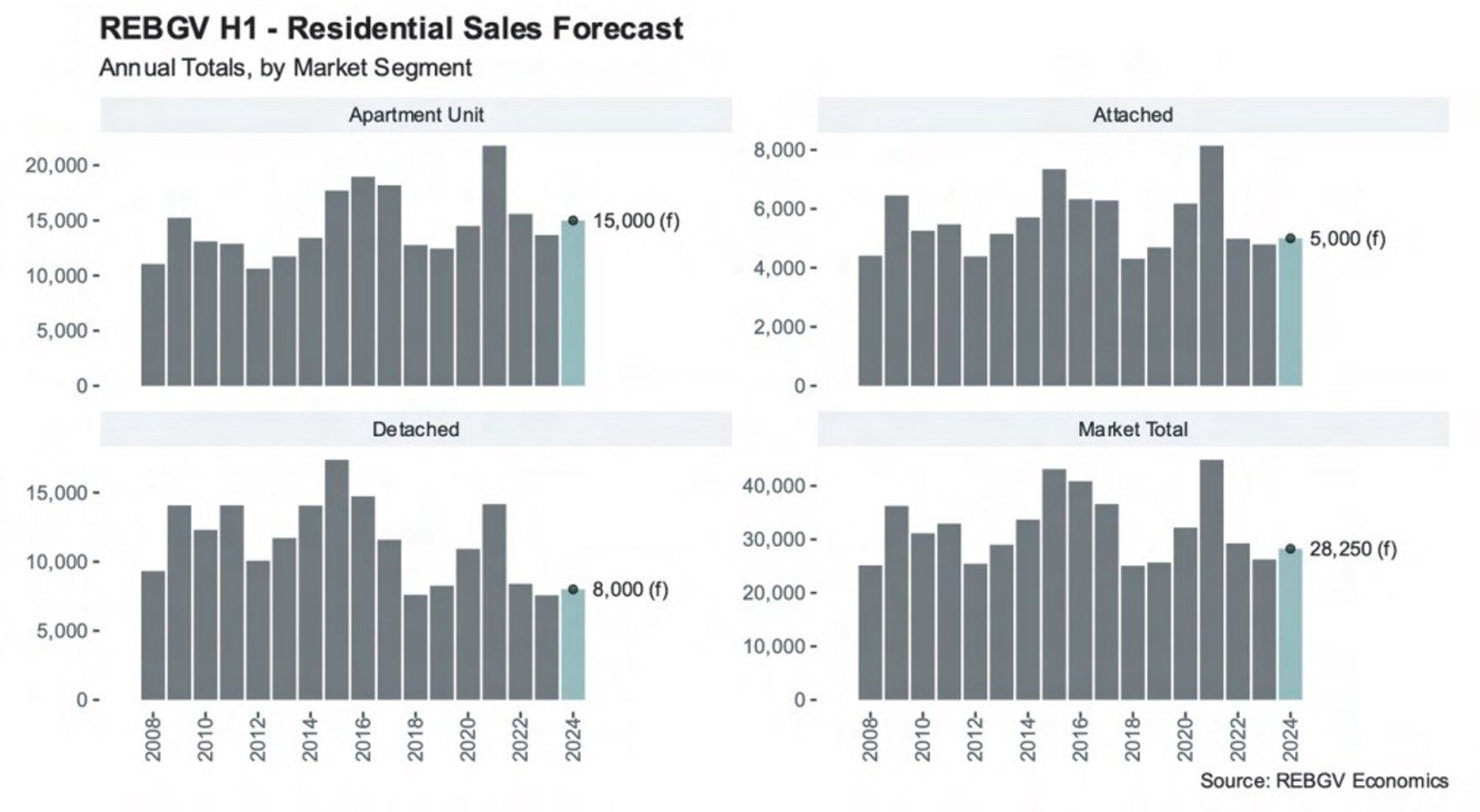

After 2023 ended with a total of 26,249 units sold, REBGV is projecting 2024 to see 28,250 units sold — an increase of 7.6%.

By property type, condominiums are projected to see a 9.7% increase, from 13,678 units sold to 15,000. Single-detached homes are then projected to see a 5.7% increase, from 7,556 units sold to 8,000. Townhouses are projected to see a 4.3% increase, from 4,793 units sold to 5,000.

Near-record-low inventory levels will continue to shape the market, and there is little to no welcome news when it comes to housing affordability. Demand remains consistent, and if market activity sees an increase like what is expected, prices are very likely to continue on their upward trajectory, REBGV says.

"Even moderate increases in demand could lead to renewed price escalation, as the pool of willing buyers continues to exceed the stock of available homes for sale," REBGV said. "This is the same dynamic we observed in 2023, and since inventory levels are only slightly higher than 2023 levels at the time of publication, we do not expect this dynamic to differ significantly in 2024."

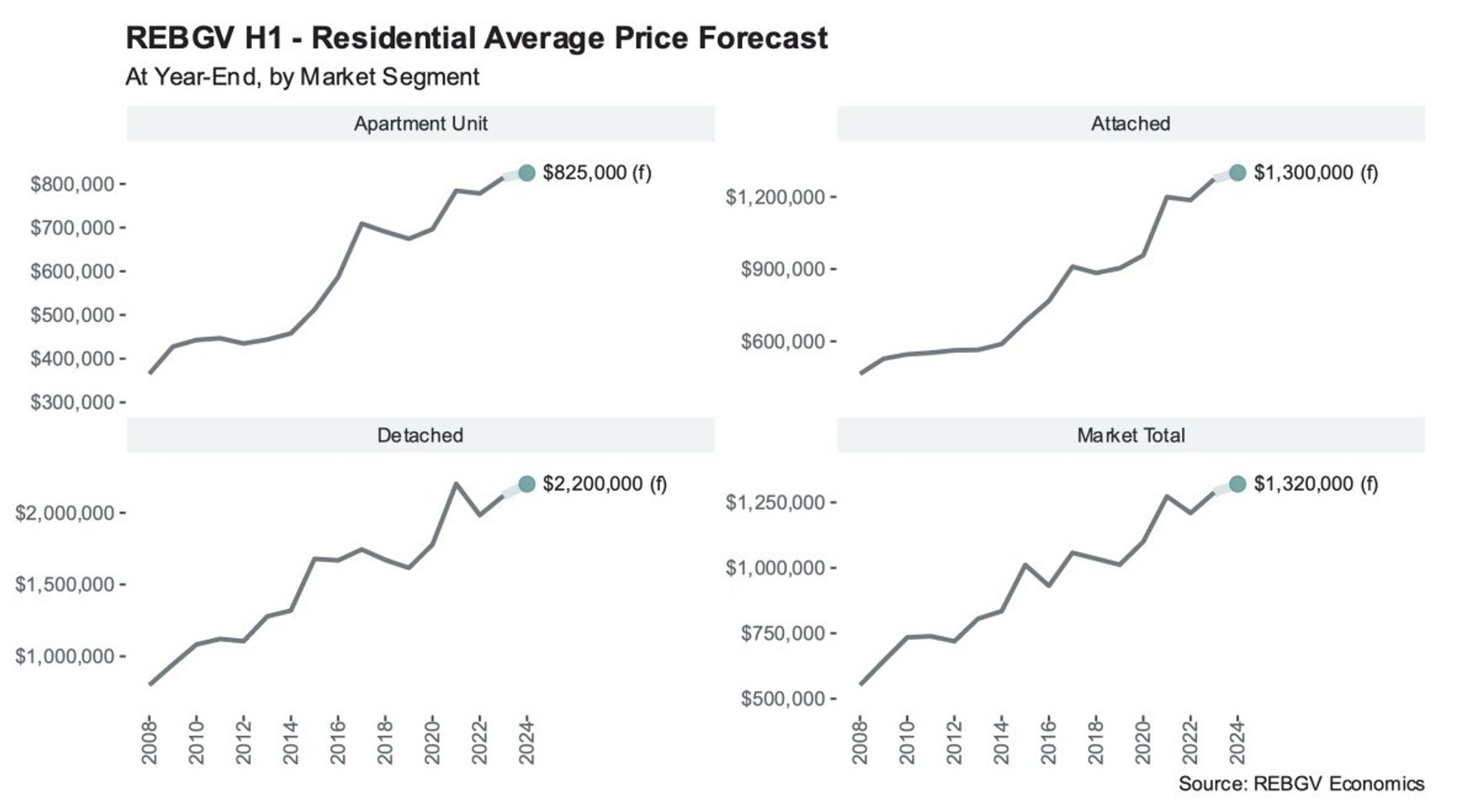

Entering 2023, REBGV forecasted the composite residential benchmark price to reach $1,200,000. The year ended with the benchmark price at a slightly higher $1,287,000.

"While the significant increase in borrowing costs over the course of 2023 led many forecasters to speculate that prices would decline during the course of the year, our modelling work suggested the opposite," REBGV said. "The simple reason for this contrarian view at the time was that the availability of resale homes was too low to lead to any significant price declines. While resale inventory levels have crept upwards since the mid-point of 2023, a longer-term perspective reveals that inventory is still hovering near historic lows."

As a result of this, REBGV is expecting prices to increase modestly this year, to $1,320,000 — a 2.6% increase.

Single-detached homes are expected to see the largest price increase, 3.9%, bringing the benchmark price to $2,200,000. Townhouses are expected to see an increase of 2.1% that will bring their benchmark price to $1,300,000. Condominiums are forecasted to see an increase of 1.4%, bringing the benchmark price to $825,000.

"With core measures of inflation finally receding to levels nearing the Bank of Canada’s target range of 1% to 3%, the risk of runaway inflation that preoccupied most of early 2023 (thankfully) now feels like a distant memory," says REBGV. "Offsetting this rosy picture, however, is the fact that the forces causing inflation to recede are related to slowing economic growth."

Unemployment remains near record lows, but slowing economic growth is of some concern. If unemployment increases and/or the economy heads into recession, residential sales could slow significantly as a result of reduced demand, and prices could also be lower than expected.

On the other hand, sales activity and prices could both be higher than forecasted if we avoid a recession and borrowing costs fall more than expected.

The Bank of Canada's next policy rate announcement is set for Wednesday, January 24.